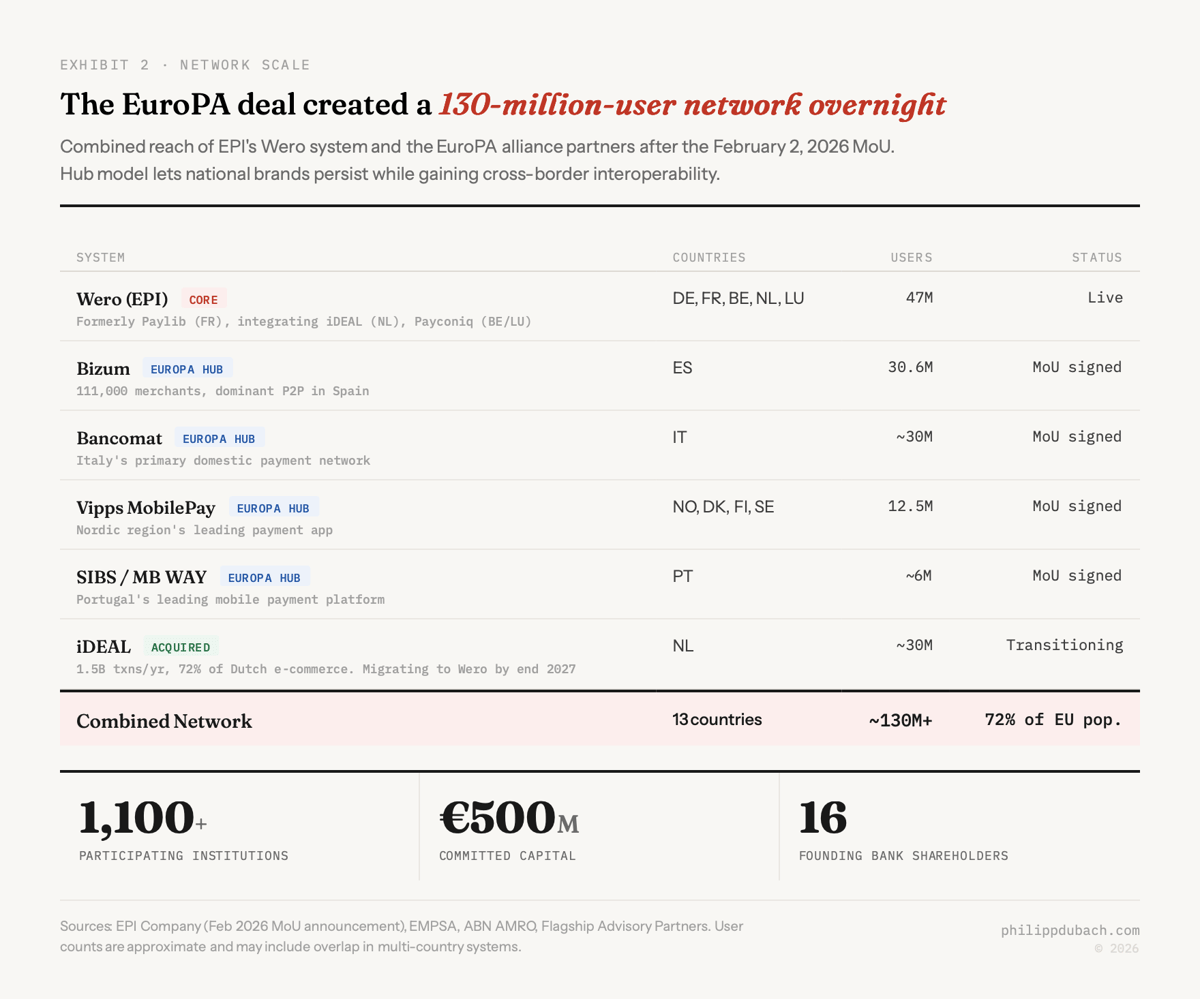

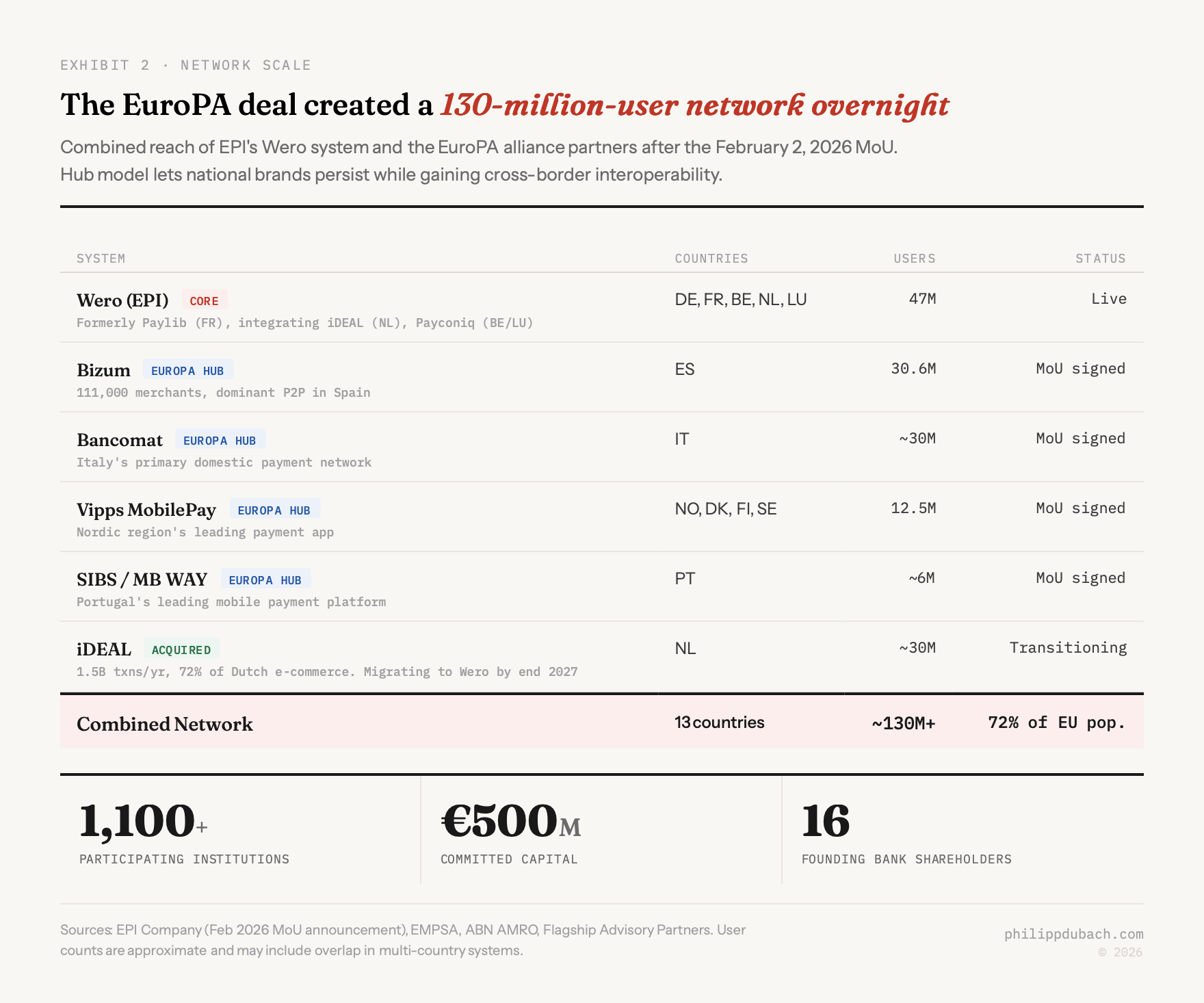

On February 2, 2026, the European Payments Initiative signed a Memorandum of Understanding with the Alliance EuroPA, a consortium linking Spain’s Bizum, Italy’s Bancomat, Portugal’s SIBS, and the Nordic Vipps MobilePay system. The deal connects 130 million users across 13 countries into a single interoperable payment network. Headlines framed it as Europe breaking up with Visa and Mastercard. The actual story is more interesting: Europe is attempting an infrastructure arbitrage that, if it works, could fundamentally reprice how money moves across the continent.

This is not primarily a sovereignty play, though that is how politicians sell it. It is an attempt to exploit a structural pricing inefficiency in European payments that Visa and Mastercard have maintained for decades and that the EU’s own regulation accidentally made harder to dislodge.

I. The hidden fee structure

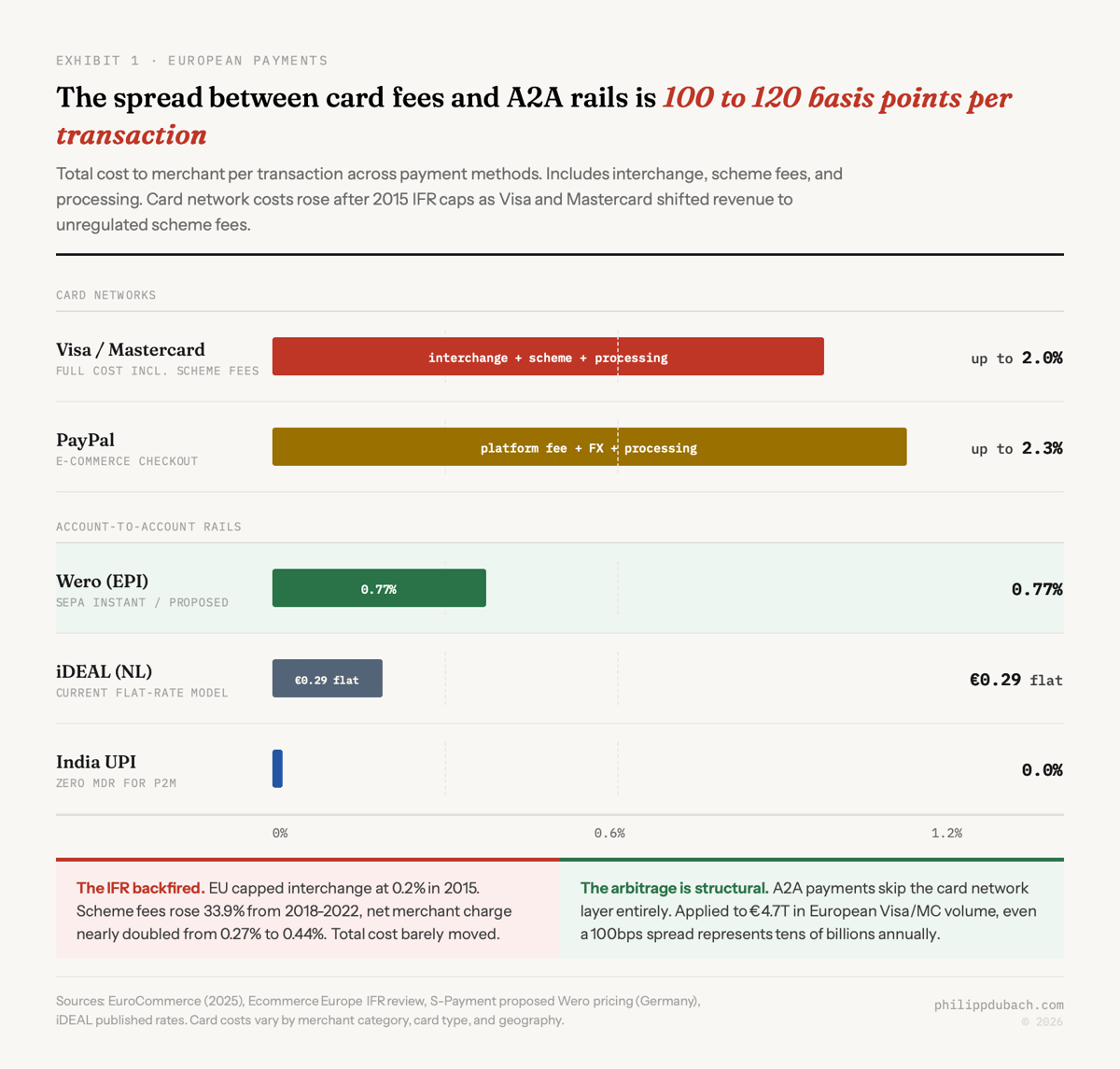

The EU’s 2015 Interchange Fee Regulation capped consumer debit interchange at 0.2% and credit at 0.3%. This was celebrated as a win for merchants. What happened next was predictable to anyone who has watched regulated industries: Visa and Mastercard shifted revenue to unregulated “scheme fees” for authorization, clearing, and settlement. According to EuroCommerce, scheme fees rose by a cumulative 33.9% between 2018 and 2022, averaging 7.6% annually. The European Commission’s own data shows scheme fees increased by €1.46 billion between 2016 and 2021. Ecommerce Europe found that the average net merchant service charge nearly doubled from 0.27% to 0.44% between 2018 and 2022, effectively neutralizing the entire regulatory benefit.

A card transaction through Visa or Mastercard can cost a European merchant up to 2% when all components are included. A SEPA Instant Credit Transfer, the rails that EPI’s Wero system uses, processes payments for a fraction of that with near-zero interchange and only processing fees. In Germany, S-Payment has proposed Wero merchant pricing at 0.77% plus gateway charges. That spread, roughly 100 to 120 basis points on every transaction, is the arbitrage opportunity. Applied to the $4.7 trillion in combined Visa and Mastercard European volume, we are talking about tens of billions of euros annually in fees that could theoretically be disintermediated.

Most analysis I read over the past days focuses on whether Wero can beat Visa and Mastercard on user experience or brand recognition. But Wero does not need to win on UX. It needs to win on cost, and the cost advantage is structural because account-to-account payments simply skip an entire layer of intermediation. The question is whether that cost advantage is large enough to overcome the switching costs, and whether the political will exists to force adoption where market forces alone might not.

II. What Wero actually is and why the impact of the EuroPA deal

Wero is a digital wallet built on top of SEPA Instant Credit Transfer infrastructure. Users access it through their existing banking app. Payments move directly between bank accounts in under 10 seconds using a phone number, email, or QR code. No card, no card network, no intermediary skimming basis points off each transaction.

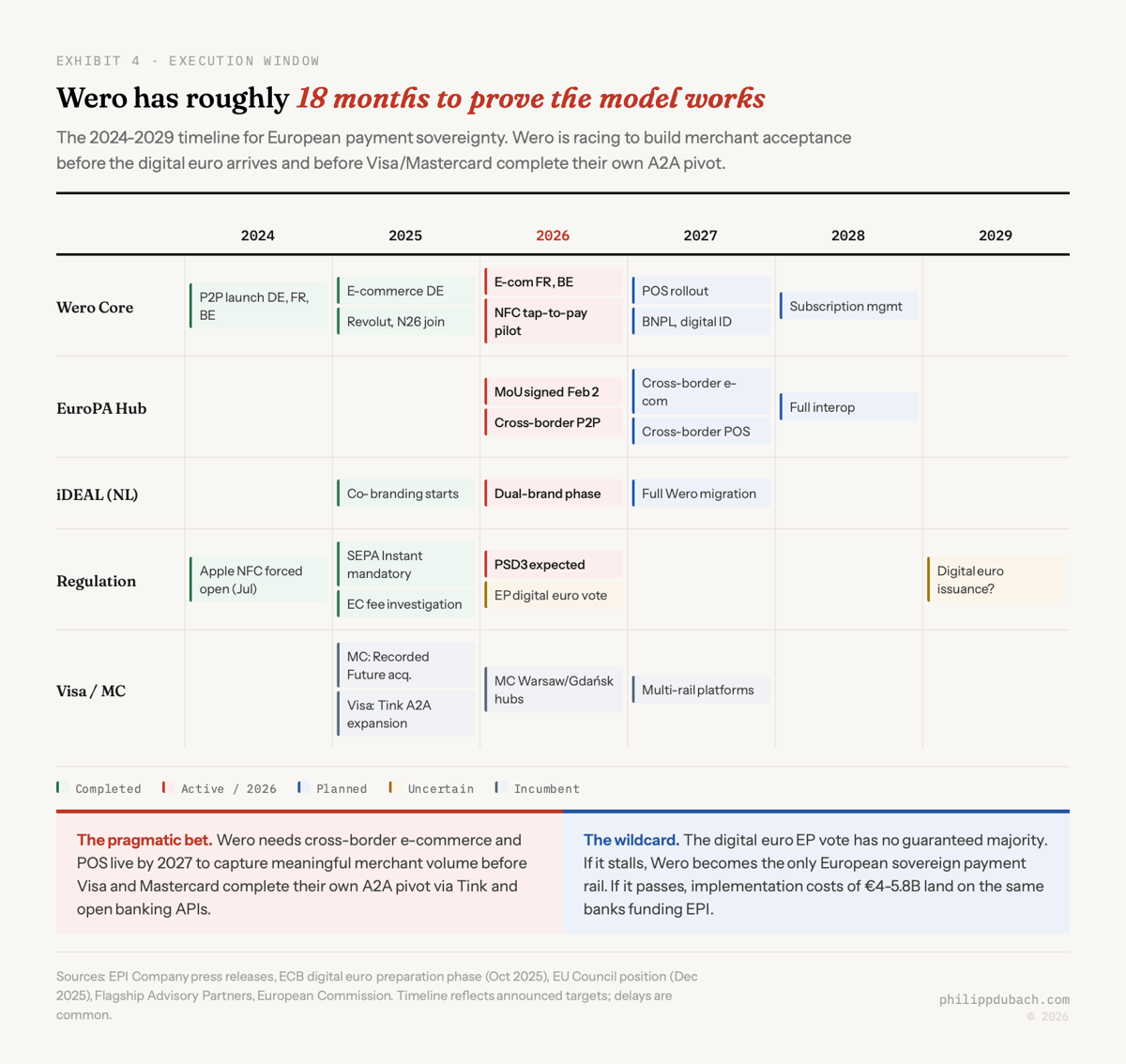

EPI launched Wero for peer-to-peer transfers in Germany on July 2, 2024, followed by France in September and Belgium in November of that year. E-commerce payments went live in Germany in November 2025, with merchants including Lidl, Decathlon, and Rossmann accepting it. Point-of-sale NFC tap payments are planned for 2026 to 2027.

The 16 founding bank shareholders include BNP Paribas, Crédit Agricole, Société Générale, Deutsche Bank, the Sparkassen-Finanzgruppe (which alone committed €150 million), ABN AMRO, ING, Rabobank, and pan-European acquirers Nexi and Worldline. Total committed capital sits at roughly €500 million. Membership has expanded to over 1,100 institutions, and both Revolut and N26 joined in 2025.

Before the EuroPA deal, Wero was a Franco-German-Benelux payments app with roughly 47 million users and a geographic footprint that excluded most of southern and northern Europe. That is not a challenger to Visa and Mastercard. The EuroPA deal changes the math because it connects Wero with Bizum’s 30.6 million users in Spain, Bancomat’s dominant network in Italy, SIBS in Portugal, and Vipps MobilePay’s 12.5 million users across the Nordics. Crucially, it does this through a hub model rather than requiring each country to join EPI as a shareholder. This is a key architectural choice because the shareholder approach already failed once: in 2021 and 2022, roughly 20 banks withdrew from EPI, including all Spanish institutions, over disagreements about governance and cost sharing.

The hub model lets national systems keep their local brands and governance while gaining cross-border interoperability. A Bizum user in Madrid will be able to pay a German merchant. An Italian Bancomat customer can transfer money to someone in France. 130 million users is not just a bigger number than 47 million, it is the difference between a niche product and something that forces merchant adoption.

EPI also acquired two established national payment systems outright. iDEAL in the Netherlands processes 1.5 billion transactions annually and handles 72% of Dutch e-commerce. Payconiq/Bancontact dominates in Belgium and Luxembourg. Both acquisitions completed in October 2023. iDEAL will transition to Wero branding by end of 2027. In France, the pre-existing Paylib service with 35 million users was directly replaced by Wero at launch. These are not greenfield user acquisition plays. They are migrating existing transaction volumes onto a unified pan-European rail.

III. The geopolitical accelerant

The economics alone might not have been enough to generate the political will for this kind of project. What changed was Russia. When Visa and Mastercard suspended operations in Russia in March 2022 following the invasion of Ukraine, they severed a market where they controlled approximately 72% of card payments. The intended target was Moscow. The unintended lesson was Brussels: payment networks controlled by American corporations can be weaponized, and what gets deployed against Russia could theoretically be turned against Europe (see my earlier post on Bretton Woods III).

ECB President Christine Lagarde has become the initiative’s most vocal political champion. In early February 2026 she told Irish radio that whether Europeans use a card or a phone, the transaction typically flows through Visa, Mastercard, PayPal, or Alipay, all of which originate from either the US or China. ECB Executive Board member Piero Cipollone has been more direct, arguing that Europe’s dependence on non-European payment solutions puts it at the mercy of decisions made elsewhere. In March 2025, ECB Chief Economist Philip Lane warned that this dependence leaves Europe “open to coercion.”

Trump’s second term has sharpened these concerns considerably. EPI CEO Martina Weimert told the Financial Times that the problem with the digital euro is that it will arrive in a few years, perhaps after Trump’s term ends, so she thinks Europe is somewhat short on time. Tariff threats, territorial claims over Greenland, and a pro-crypto, anti-CBDC US policy agenda have turned European payment sovereignty from a technocratic aspiration into something closer to a defense priority. And European defense spending is the one area where political consensus currently exists across virtually all member states.

This framing is important for understanding why Wero might succeed where its predecessors failed. The Monnet Project collapsed in 2012 when the European Commission refused to support multilateral interchange fees. The original EPI card-scheme vision was abandoned after the bank withdrawals. The Nordic P27 initiative collapsed in 2023. Each failure happened in a geopolitical context where the urgency was abstract. The urgency is no longer abstract. When 70 economists including Thomas Piketty published an open letter in January 2026 calling the digital euro “the only defence” against dependence on US payment systems, that represents a shift in the Overton window that did not exist even two years ago.

IV. Profitability

The EU’s own interchange fee regulation, the one designed to protect merchants from Visa and Mastercard, has inadvertently created what I think is one of the largest barriers to entry for any new European payment network.

When interchange is capped at 0.2% for debit, the revenue pool available to fund a new network is tiny. Visa and Mastercard can sustain their European operations because they amortize costs across a $24 trillion global transaction base. A new European entrant has to build comparable infrastructure, convince hundreds of thousands of merchants to integrate, and acquire tens of millions of users, all while operating in a margin environment that was deliberately compressed by regulation. Weimert herself has estimated that building a viable full-scale alternative requires “several billion euros,” with private estimates cited by Fortune ranging as high as €6 billion.

This is what often happen with bad regulation. The regulation that was supposed to weaken the duopoly has actually strengthened its competitive moat by making the economics of entry worse. Visa and Mastercard responded to interchange caps by raising unregulated fees, so their total revenue per transaction barely changed. But a new entrant cannot charge those same scheme fees without undermining its cost advantage proposition. The revenue has to come from somewhere else.

EPI’s answer is value-added services: buy-now-pay-later, digital identity, subscription management, loyalty programs. None of these exist yet. They are on the roadmap for 2027 and beyond. In the meantime, Wero operates as a cost center subsidized by its bank shareholders. The Sparkassen’s €150 million commitment is patient capital from a cooperative banking group with a 200-year time horizon. BNP Paribas and Crédit Agricole can absorb the costs as a strategic investment. But the question of when, or whether, Wero becomes self-sustaining is genuinely open.

V. India and Brazil comparisons are both more and less instructive than they appear

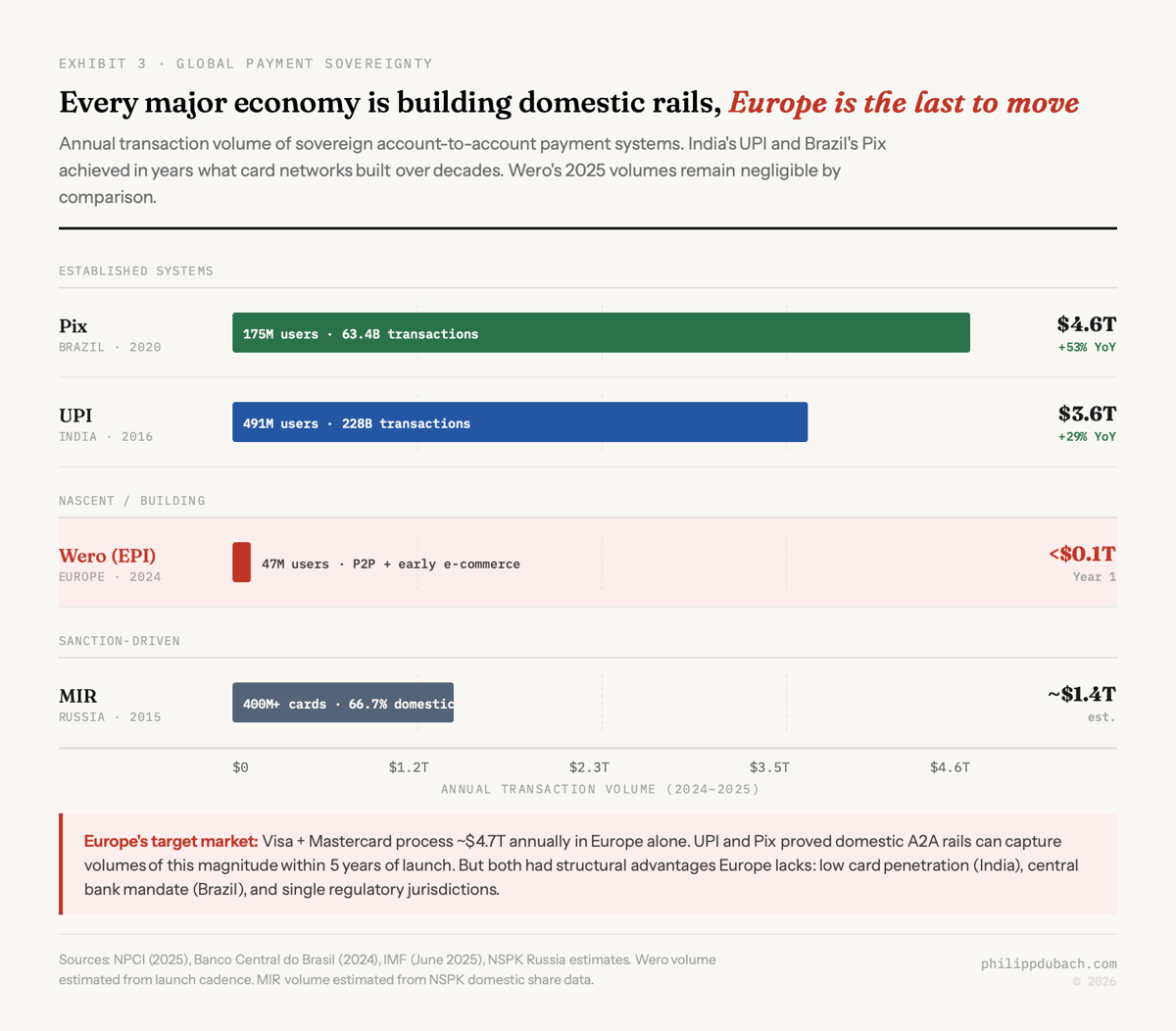

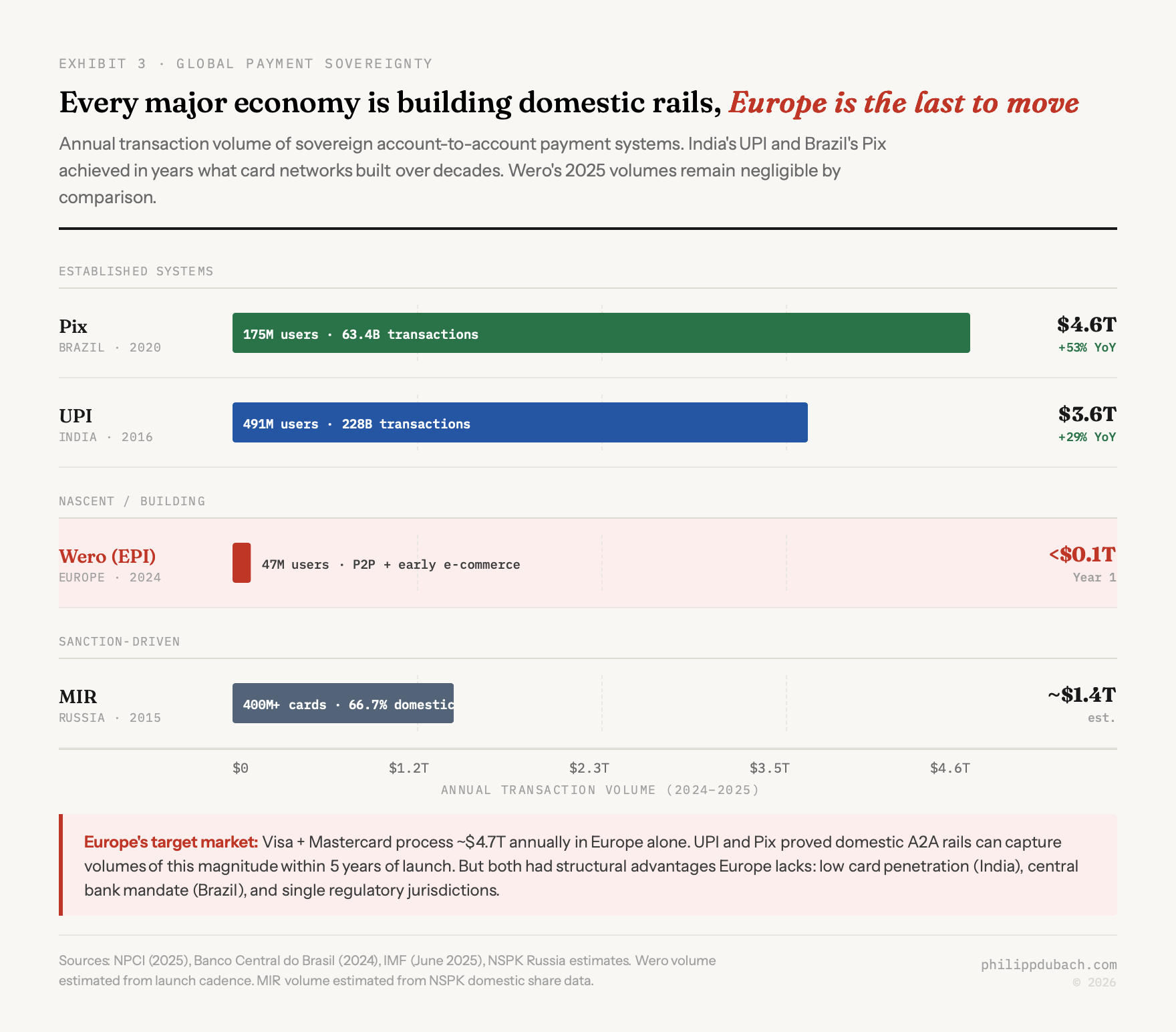

Every article about Wero mentions India’s UPI and Brazil’s Pix as proof of concept. The numbers are undeniably impressive. UPI processed 228.3 billion transactions worth approximately $3.6 trillion in 2025, up 29% year-over-year. The IMF recognized it in June 2025 as the world’s largest retail fast-payment system. Brazil’s Pix reached 175 million users and processed 63.4 billion transactions worth $4.6 trillion in 2024, growing 53% year-over-year. Both systems achieved in a few years what Visa and Mastercard built over decades.

But the structural conditions that enabled UPI and Pix do not map cleanly onto Europe. India had a large unbanked population and low existing card penetration. UPI did not have to displace an entrenched incumbent so much as fill a vacuum. Pix launched via central bank mandate requiring every financial institution to participate, with zero-cost transfers for individuals. Both countries also had single regulatory jurisdictions and populations accustomed to mobile-first payments.

Europe has none of these conditions. Card penetration is high. Consumer habits are entrenched. The regulatory landscape spans 27 member states plus associated countries, each with their own banking traditions and payment preferences. There is no single authority that can mandate participation the way Brazil’s central bank did.

What Europe does have, and this is the part most analysts underweight, is a functioning SEPA infrastructure that already connects every bank account in the eurozone. Wero does not need to build new rails. It needs to build a user interface and merchant acceptance layer on top of rails that already exist and that already process trillions of euros annually. The SEPA Instant Credit Transfer regulation that became mandatory in 2025 means every eurozone bank must support real-time payments. Europe’s governments have already paid for the highway. Wero is building the on-ramps.

The other underappreciated advantage is regulatory asymmetry. The EU’s July 2024 ruling forcing Apple to open iPhone NFC access to third-party wallets means Wero can offer tap-to-pay on iPhones without going through Apple Pay. PSD3, expected in 2026, will likely further strengthen open banking requirements. The European Commission has active investigations into Visa and Mastercard’s fee structures. In the UK, the Competition Appeal Tribunal ruled unanimously in June 2025 that the networks’ interchange fee structures breach competition law. Europe is not just building an alternative. It is simultaneously making the incumbent’s business model harder to sustain.

VI. Visa and Mastercard

Neither company has made extensive public statements about Wero, which is itself a strategy: do not elevate the challenger’s profile. When pressed, they emphasize the value they provide. Mastercard CEO Michael Miebach argued on an October 2025 earnings call that wherever cards are available in a competitive, level playing field, businesses and consumers opt for cards because of the protections they offer.

But both companies are executing a quiet multi-rail pivot. Visa acquired European open banking leader Tink for approximately $2.2 billion in 2022, gaining the capability to offer the same account-to-account payment rails that Wero uses. Mastercard acquired cybersecurity firm Recorded Future for $2.65 billion in September 2024, expanding into value-added services. Both are positioning themselves as payment technology platforms rather than pure card networks.

This is rational. If account-to-account payments do take share from card networks in Europe, Visa and Mastercard want to be the infrastructure layer that processes those payments too. They have the merchant relationships, the fraud detection capabilities, and the global acceptance network. The risk for Wero is that even if it succeeds in shifting transactions off card rails, the toll collectors simply move to the new road.

The digital euro

Running in parallel is the ECB’s digital euro project, a central bank digital currency that would serve as legal tender across the eurozone. The EU Council agreed its negotiating position in December 2025. A European Parliament vote is expected in the first half of 2026, with potential first issuance around 2029. In October 2025, the ECB completed its preparation phase and declared the digital euro technically ready.

EPI positions Wero as complementary, handling private money while the digital euro handles public money. But the overlap in ambition is obvious, and it creates a coordination problem. Banks worry about deposit outflows and implementation costs estimated at €4 to 5.8 billion. There is no guaranteed parliamentary majority for the legislation. And Trump’s anti-CBDC stance, including signing the GENIUS Act for stablecoins while banning federal CBDCs, creates a strange dynamic where Europe might pursue a digital euro partly as a response to American policy that explicitly rejects the concept.

My read is that the digital euro and Wero are less complementary than they are competing bets on the same thesis: that Europe needs sovereign payment infrastructure. The digital euro is the maximalist version. Wero is the pragmatic one. If I had to bet, I would bet on the pragmatic version arriving first and capturing enough transaction volume to make the digital euro’s incremental value harder to justify politically. But both could fail. And both failing would leave Europe exactly where it started, which is the outcome Visa and Mastercard are quietly optimizing for.

What’s next

The next 18 months are decisive. Cross-border P2P payments through the EuroPA hub launch in 2026. E-commerce expansion to France and Belgium follows in the second half of the year. Cross-border e-commerce and point-of-sale payments via the hub are targeted for 2027. iDEAL’s full migration to Wero should complete by end of 2027.

The biggest risk is not technology or regulation. It is consumer inertia. Wero has 47 million users, but Mastercard alone has over 900 million branded cards in EU circulation. Credit cards offer credit facilities, rewards programs, and purchase protection that Wero currently cannot match. German adoption has been notably sluggish: despite being the first launch country, Germany accounts for only 5% of Wero’s transaction volume, with France dominating thanks to its Paylib migration. Dutch merchants have pushed back on the shift from iDEAL’s flat €0.29 per transaction to Wero’s percentage-based model.

I think the outcome depends on whether European policymakers treat this as a market initiative or a strategic infrastructure project. If it is the former, the cost advantages may not be enough to overcome switching costs and consumer habit. If it is the latter, and if governments are willing to subsidize adoption the way they subsidize defense procurement, then the math works. The 130-million-user network created by the EuroPA deal gives Wero something no previous European payment initiative has achieved: a user base large enough to force merchant adoption through sheer volume. Whether that is enough depends on a political question, not a technical one.

The $24 trillion figure in the headline refers to Visa and Mastercard’s combined global transaction volume. Europe’s share is roughly $4.7 trillion. Even capturing 10% of that would represent one of the largest shifts in payment infrastructure in European financial history. The infrastructure arbitrage is real. The spread between card network fees and SEPA Instant costs is measurable and persistent. The question is execution, and execution in Europe is always the question.